Home > Creating a Business Plan > Fixed Assets

Fixed Assets

FINANCIAL PLAN > Assets > Fixed assets

The "Fixed assets" worksheet is intended for planning purchases of fixed assets (equipment, machinery etc).

It is also possible to plan finance leases and grant financing of fixed assets with iPlanner software.

If plans are made for ongoing business, you can take into account the value of fixed assets (see below "Entering existing fixed assets") and existing finance leases and grant financing.

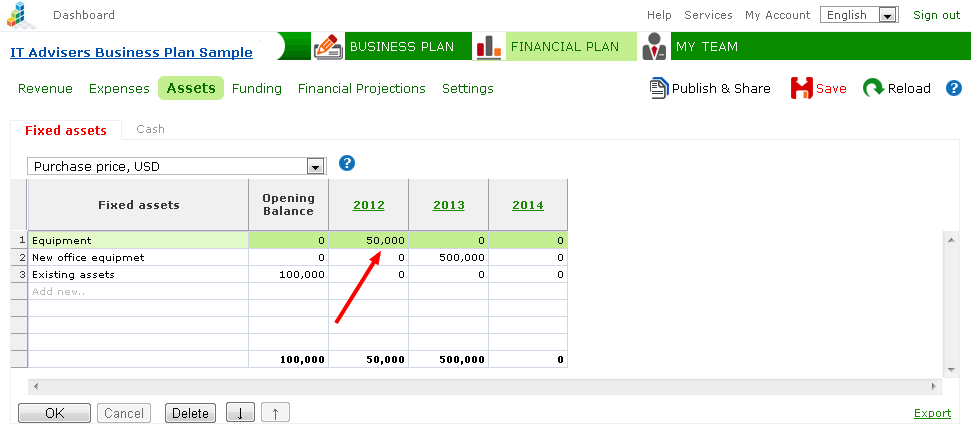

In an empty table row, insert the name of the assets in the "Fixed assets" column.

Select the "Purchase price" input parameter and insert the purchase price for assets in the column that corresponds to its acquisition date. Click "OK".

Input parameters

| Purchase price |

Enter the purchase price for the fixed assets. Select the period that corresponds to its acquisition date.

In general, the purchase price should be entered without VAT, unless VAT will not be returned.

In cases of ongoing business: insert a row named something like "Existing fixed assets."

In the "Opening value" column, insert the net value of existing fixed assets (i.e., acquisition cost minus depreciation).

If existing fixed assets have lease obligations, these can be recorded as well (see below: "Entering existing fixed assets").

|

Payable period

(in days) |

Basically a payment term. Enter the number of days until assets are paid for.

|

Depreciation rate

(%) |

Enter the yearly depreciation rate for the fixed assets.

The depreciation rate is the percentage rate at which an asset is depreciates. It is computed by dividing the purchase value of the asset by the number of years in asset's estimated productive or useful life.

For

example, a depreciation amount of 20% would mean that its expected use is 5 years. If the depreciation rate is set at 100%,

its expected use would be one year.

NB!

Regardless of the chosen input period

(month, quarter or year), the depreciation rate is always considered on an

annual basis.

|

Residual value

(%) |

Enter the residual value of fixed assets (%). This is the residual value in terms of depreciation.

Residual value is the estimated scrap value (salvage value) of an asset at the end of its useful life.

When the value of an asset minus its accumulated depreciation equals its residual value, the asset cannot be depreciated anymore. Usually the residual value is zero.

Residual value = Purchase price x Residual value (%)

|

| Finance lease: financing level (%) |

Recording finance lease

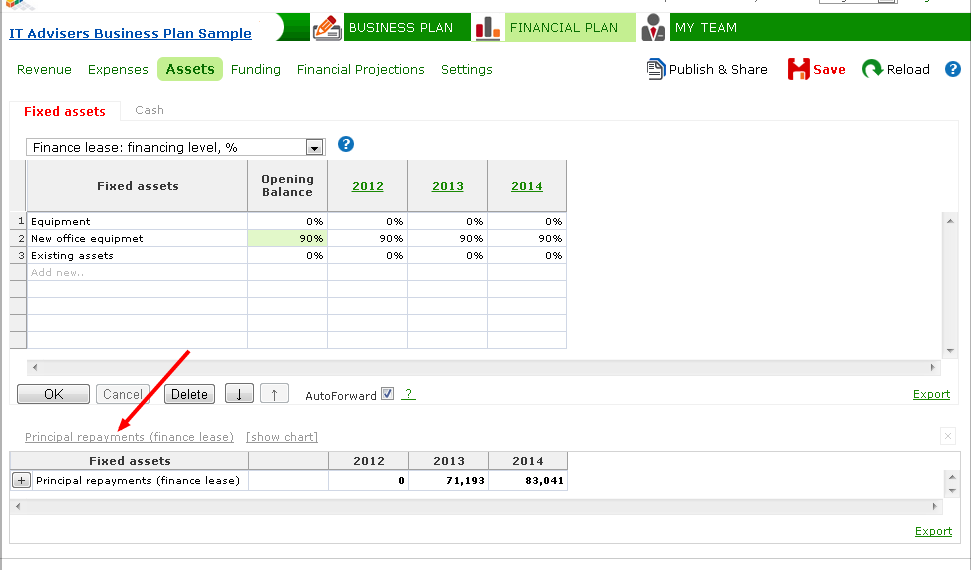

If assets are purchased with finance lease, enter the financing rate (%).

Financing rate shows the relative share of purchase cost that is

financed by finance lease. For example, if the self-financing is 10%,

the financing rate will be 100% - 10% = 90%.

Make sure that the purchase price and the non-zero financing rate are entered in same period.

NB! Financing rate is a key parameter. If its value is not zero, iPlanner will automatically compose a payment schedule, considering other parameters (term, interest rate, residual value) as well.

|

| Finance lease: term (in months) |

Enter

the lease term in months. Make sure

that the contract term would be entered in the same period as the purchase of the asset.

In case of ongoing business: if you want to take into account the term of an existing lease contract, enter the number of months remaining until the end of the contract term.

|

| Finance lease: interest rate (%) |

Enter the interest rate provided in the lease contract (on annual basis). |

| Finance lease: residual value (%) |

Enter the residual value in the lease contract terms (%). This input parameter is relevant, if the payment schedule has been prepared with non-zero residual value.

In lease contract terms, residual value is a part of the cost of the asset, which shall be paid for at the end of the leasing contract, and which will be paid via single payment in the last month. |

| Grant financing: financing level (%) |

Planning grant financing of fixed assets

If the purchase of fixed assets is financed through grant financing, enter the financing rate (%). This is a key parameter, and its non-zero value will start the calculation of grant financing in financial projections.

For example, if government support covers 70% of the acquisition cost of fixed assets (which means that the amount of self-financing is 30%), you should enter the financing rate as 70%.

Make sure that non-zero financing rate is entered on the same period as the acquisition of fixed assets.

If you are dealing with existing fixed assets (i.e., ongoing business), and you need to continue to show grant financing for this asset, enter the corresponding grant financing rate in the "Opening value" cell. In doing so (NB!), if the grant has bee received - i.e., it was received before the first month of the business plan - select the input parameter "Grant financing: collection period" and enter 0 days in the "Opening value" column.

|

| Grant financing: collection period (in days) |

Enter the predicted number of days from the purchase of asset to the receipt of grant financing.

In cases of ongoing business:

- Entering 0 days in the "Opening value" column would mean that grant financing has already been received (i.e., the grant was received before the first month of the business plan);

- An amount of days other than zero would mean that the grant will be received within the business plan schedule.

|

Entering existing fixed assets

If plans are made for ongoing business, you can take into account the value of existing fixed assets and continue calculating their depreciation.

Enter in an empty table row "Existing fixed assets", for example, and enter the net value of these fixed assets (i.e. acquisition cost minus depreciation) in the "Opening balance" column.

If existing fixed assets have a finance lease obligation, proceed as follows:

- Select input parameter: "Finance lease: financing level (%)" and enter the portion covered by the obligation from the net value of the asset in "Opening value" column.

- Select input parameter: "Finance lease: term (m)" and enter the number of months until the end of the contract in the "Opening value" column.

- Select input parameter: "Finance lease: interest rate (%)" and enter the interest rate in the "Opening balance" column.

- If the residual value of leased property is other than zero, enter the residual value (%) in the "Opening balance" column.

Display output projections

To verify the correctness of entries made, it is a good idea to look at the "machine" generated payment schedules and other output projections.

For example, if you enter the parameters of the lease, the payment schedule can be reviewed via table or graph at the bottom of the worksheet. To do this, you can select the output projection of interest from the drop-down menu shown below, such as "Principal repayments (financial lease)" and see if the result is as expected. If necessary, you can correct the input parameters, to achieve desired results.

See more

Grant Financing

Opening Balances

Worksheet Features

Saving and Team Work

Publishing and Sharing

Team Building

|